Nanny tax calculator

Already Have an Account. Minimum wage rates are on the rise for 2022 in many states counties and cities across the country.

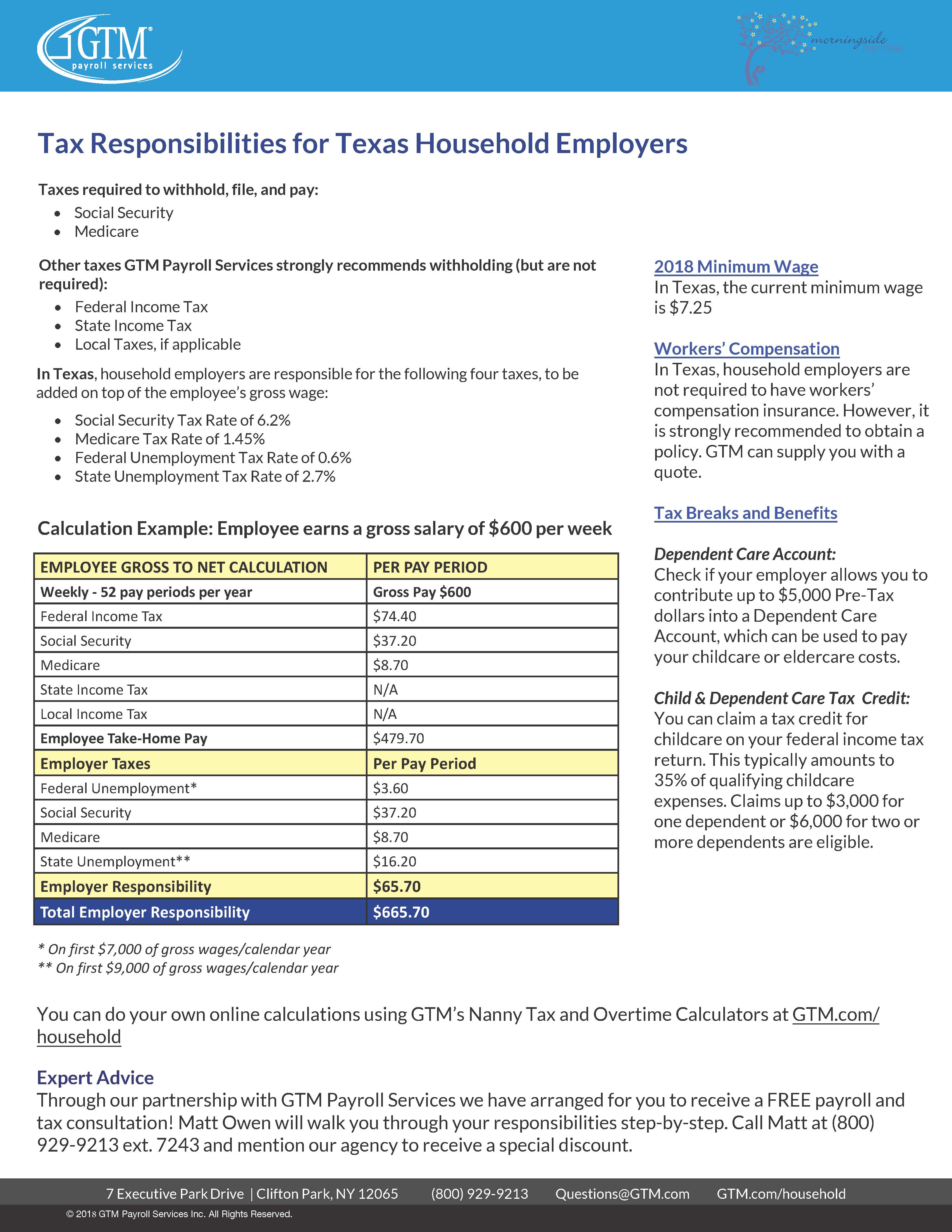

2018 Nanny Tax Responsibilities

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again after this point with the changes detailed in our tax rates and thresholds page.

. The Nanny Tax is also not good news. Nanny Tax Calculator Cost Calculator for Nanny Employers. Do I still need to file a return.

There are two ways to calculate taxes on bonuses. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll. Nanny Taxes Nanny Payroll Guide Benefits HR Nanny Household Benefits HR.

If you hire your nanny or caregiver through an agency the agency may be the employer and have to take care of all the paperwork. The answer depends on many factors including where you live whether youll pay for childcare and which baby products you choose. Calculate Federal Insurance Contribution Act FICA taxes using this years Medicare.

Check e-file status refund tracker. NannyPay nanny tax software will save you thousands of dollars over popular nanny tax. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver.

The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses. MyTamarin are now Londons leading Nanny and Maternity Nurse provider working with only the very best nannies and experts. More than just a tax calculator NannyPay will maintain all your nanny tax payroll records.

The percentage method and the aggregate method. Social Security Medicare taxes FICA as well as federal state income taxes. The aggregate method is more complicated and requires you to check out the tax rates listed on IRS Publication 15.

You will still need to file your annual return Form VA-6H by Jan. NannyPay is secure and cost-effective nanny tax payroll management software for calculating taxes for your nanny babysitter housekeeper personal assistant or any household employee. The federal minimum wage rate was raised to 725hour in 2009.

Change the amounts and selections below to get a customized estimate. Skip To The Main Content. I registered for a household employer withholding tax account but I didnt have any employees this year.

The nanny tax is a combination of federal and state tax requirements detailed in IRS Publication 926 that families must manage when they hire a household employee such as a nanny senior caregiver or personal assistant. Still this Baby Costs Calculator can help you get a sense of how much youre likely to spend during your babys first year. We are nationally recognized experts in the field of household employment taxes regularly consulted by media such as the New York Times and Wall Street Journal.

Taxes withheld from the employee. If you hire someone to come into your home to help care for your new child you could become an employer in the eyes of the IRSand face a whole new set of tax rules. Find Child Care Babysitters Senior Care Pet Care and.

Any employee pension payments will be deducted from the. Additionally state income tax rates vary. Started by parents created for families.

HomeWork Solutions specializes in providing household employers and their tax preparers real solutions for nanny tax compliance. You must make a separate filing on Form VA-6-H by Jan. Review current tax brackets to calculate federal income tax.

Determine if state income tax and local income tax apply. What are nanny taxes. Take these steps to determine how much tax is taken out of a paycheck.

Can I report and pay the tax due with my individual income tax return. Nannies and other household employees are covered by the Fair Labor Standards Act which means they must be paid the prevailing minimum wage rate. Were not like a traditional nanny agency - our in-house childcare experts psychologists and dedicated matching specialists ensure youre matched only with the very best nannies for you and your family -.

Nanny Tax Calculator Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Calculator Nanny Lane

How To Create A W 2 For Your Nanny Nanny Tax Tools

Nanny Tax Payroll Calculator Gtm Payroll Services

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Paycheck Nanny Calculate Tax Apps On Google Play

How To Calculate Your Nanny Taxes

How To Reduce Your Nanny Taxes Aunt Ann S In House Staffing

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

How To Catch Up On Year End Taxes For Household Employees Sittercity

The Ultimate Nanny Tax Guide Nannypay

Household Employment Blog Nanny Tax Information Household Paycheck Calculator

Nanny Tax Payroll Calculator Gtm Payroll Services

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Try Our Nanny Tax Calculator